What Is The Futa Tax Rate For 2025

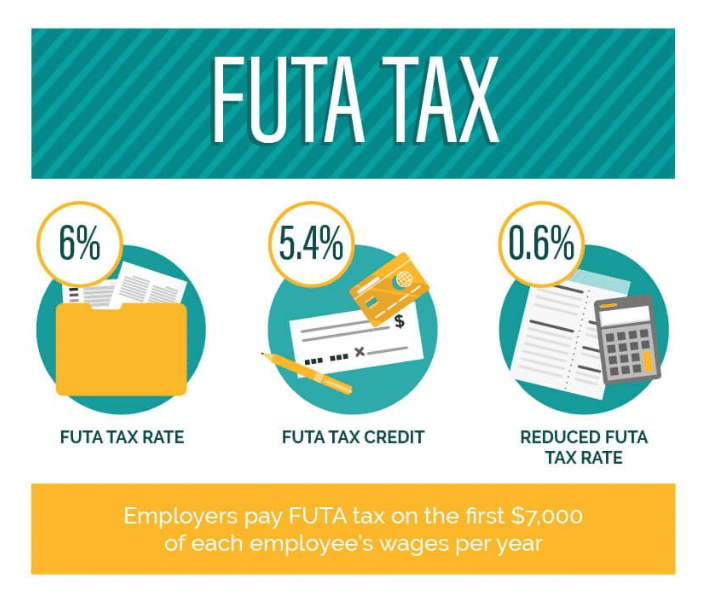

What Is The Futa Tax Rate For 2025. 2025 might be the time to start thinking about estate taxes and creating a gifting plan. The basic futa rate is 6%.

State payroll taxes include income tax, unemployment tax, and in some states and cities, local taxes.

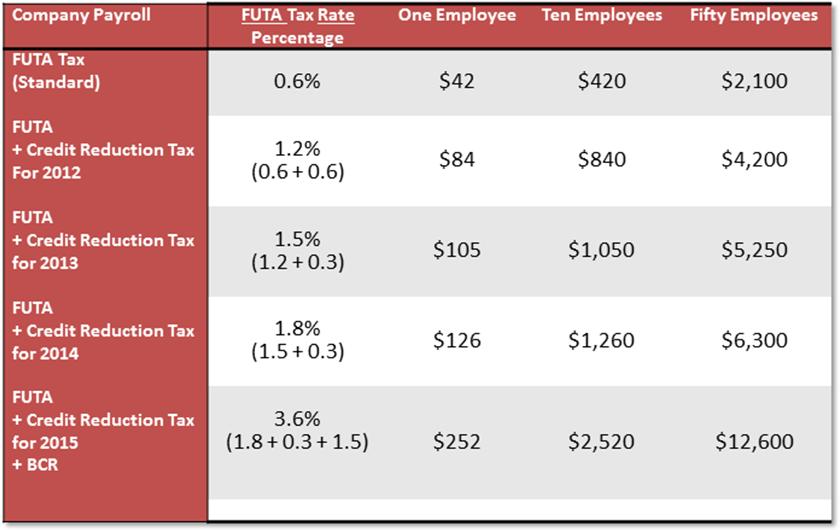

As a result, california is experiencing an additional 0.3% in their futa credit reduction rate, which means employers in 2025 will have to pay a higher futa.

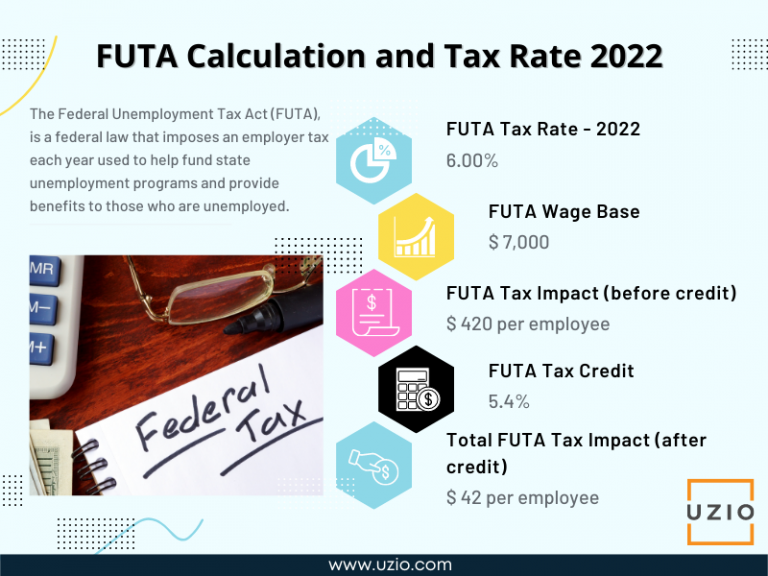

What is FUTA? Federal Unemployment Tax Rates and Information for 2025, Usually, your business receives a tax credit of up to 5.4% from the federal government when it pays its state unemployment tax, effectively reducing. For any amount of wages exceeding.

What is FUTA? Definition & How it Works QuickBooks, The state unemployment tax act is a tax that funds unemployment benefits. Again, considering that the maximum wages subject to.

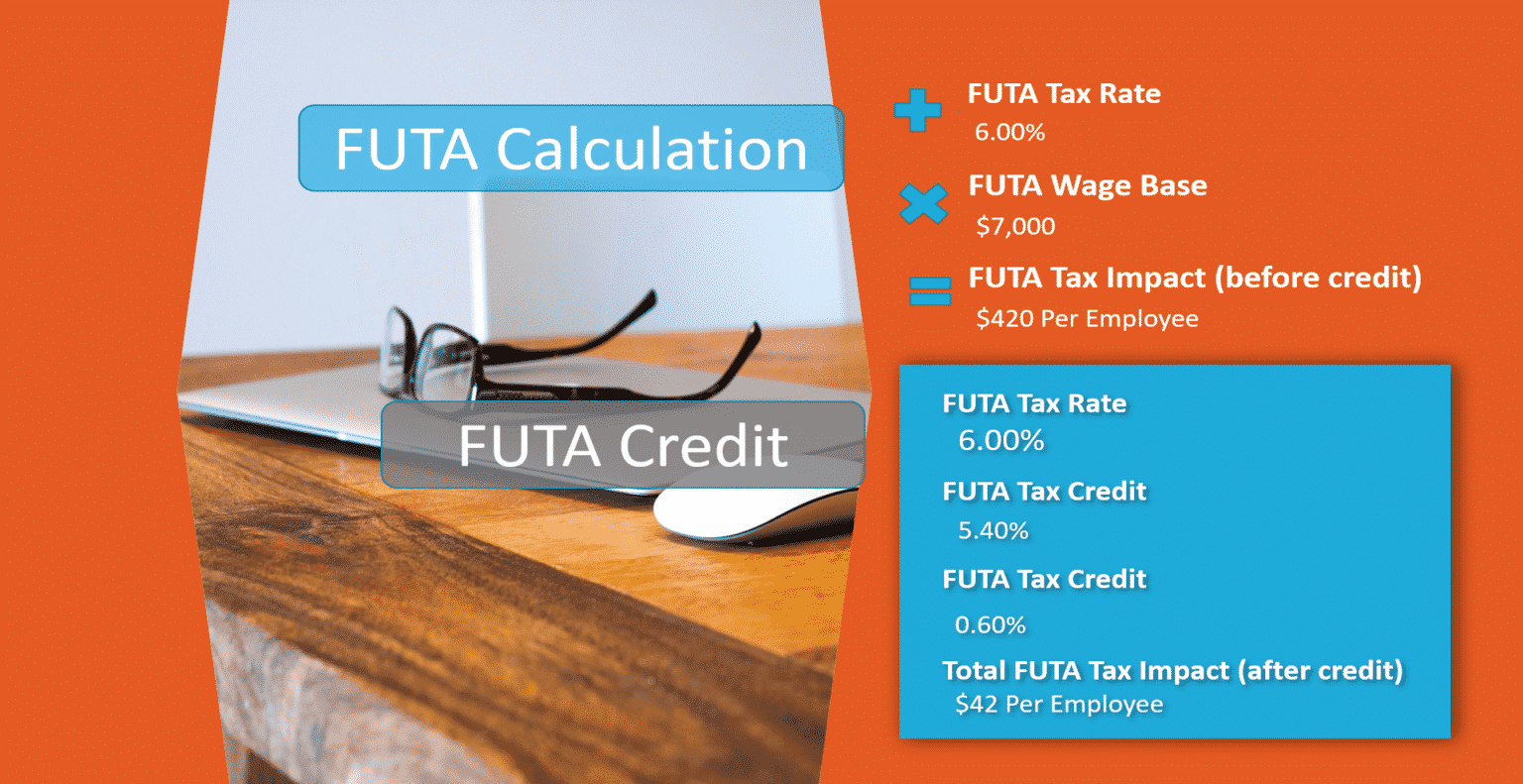

FUTA Tax How to Calculate and Understand Employer’s Obligations UZIO Inc, 6.2% for the employee plus 6.2% for the employer; The current gross futa tax rate is 6.0% of taxable wages, to be paid by the employer only.

FUTA Tax Calculation Accuchex, The tax only applies to this first $7,000. Futa tax is unique from other types of payroll taxes, such as the social security tax, which is imposed on both employees and employers equally.

Federal Unemployment Tax Act (FUTA) Definition & Calculation, Without further legislation in congress. The futa tax rate as of 2025 is 6% of the first $7,000 of each employee’s wages during the calendar year.

What Is FUTA Tax? It Business mind, Without further legislation in congress. The futa tax rate as of 2025 is 6% of the first $7,000 of each employee’s wages during the calendar year.

FUTA Federal Unemployment Tax Act What is FUTA? The Federal, These taxes are placed in. The current gross futa tax rate is 6.0% of taxable wages, to be paid by the employer only.

FUTA Tax Rate Discover What It Is and How It Works, For any amount of wages exceeding. Therefore, employers shouldn't pay more than $420.

FUTA Tax Rate 2025 Unemployment Zrivo, The current futa tax rate is 6%. Every eligible employer in the us, including in wyoming, has to take the federal insurance contributions act (fica) into account when deducting.

FUTA Taxes & Form 940 Instructions, Without further legislation in congress. The federal unemployment tax act (futa) requires that each state’s taxable wage base must at least equal the futa taxable wage base of $7,000.