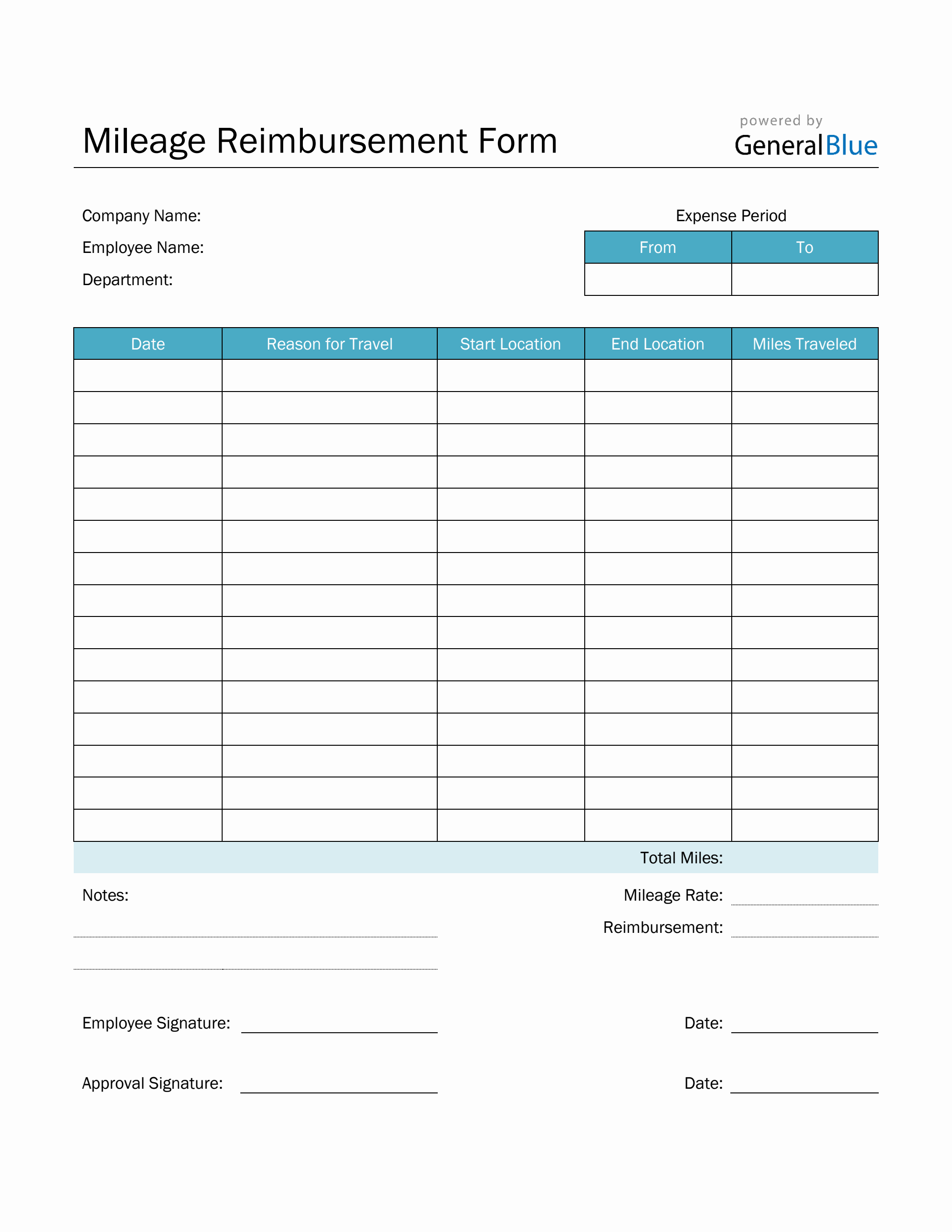

Current Federal Mileage Rate 2025 Opm

Current Federal Mileage Rate 2025 Opm. 14 cents per mile for charitable use. New standard mileage rates are:

The rate table below shows the new rates that have been officially published on the gsa website at the following link: Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025.

Vehicle rates are based on a monthly lease and mileage charge, which includes all maintenance and fuel expenses.

Pa Mileage Reimbursement 2025 Ingrid Catrina, If approved, fsafeds participants can be reimbursed for mileage and parking expenses for travel to and from your doctor, dentist, pharmacy. The general services agency (gsa) has released new rates for reimbursement of privately owned vehicle (pov) mileage for 2025.

IRS Issues 2025 Standard Mileage Rates UHY, For a full schedule of per diem rates by destination, click on any of the states below. Privately owned vehicle (pov) mileage reimbursement rates.

Mileage Rate 2025 Top 5 Insane Tax Hacks You Need!, For travel to and from a health care provider, the mileage rate changes annually. For a full schedule of per diem rates by destination, click on any of the states below.

2025 Mileage Rates — Kakenmaster Tax & Accounting, For travel to and from a health care provider, the mileage rate changes annually. The new rate is $0.67 per mile.

IRS Announces 2025 Mileage Reimbursement Rate, The new rate is $0.67 per mile. 65.5 cents per mile for business use.

IRS Releases 2025 Standard Mileage Rates BMF, 5305 (or similar special rate under other legal authority) are entitled to the higher special rate. A mileage allowance for using a privately owned vehicle (pov) for local, temporary duty (tdy), and permanent change of station (pcs) travel is reimbursed as a rate per mile in lieu of reimbursement of actual pov operating expenses.

Irs Rate For Mileage Reimbursement 2025 Peggy Blakelee, This rate reflects the average car operating cost, including gas, maintenance, and depreciation. The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year.

2025 Mileage Rates, 18 cents per mile for medical or moving purposes. This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

Everlance’s 2025 IRS Mileage Rate Guide for Electric Vehicles, The charitable rate is not indexed and remains 14 cents per mile. 14 cents per mile for charitable organizations.

2025 IRS Mileage Rates Guide Trends, Tips, and Deduction Wisdom, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025. Subsequently, on 05/14/2025, the department of the interior (doi) requested that it be added to the agency coverage.

Other general schedule employees covered by this table whose pay rate at their grade and step on this table is below the rate for the same grade and step on an applicable special rate table under 5 u.s.c.